Top Guidelines Of Clark Wealth Partners

Table of ContentsThe Main Principles Of Clark Wealth Partners An Unbiased View of Clark Wealth Partners9 Simple Techniques For Clark Wealth PartnersClark Wealth Partners - The FactsThings about Clark Wealth PartnersIndicators on Clark Wealth Partners You Need To KnowThe Only Guide to Clark Wealth PartnersGetting My Clark Wealth Partners To Work

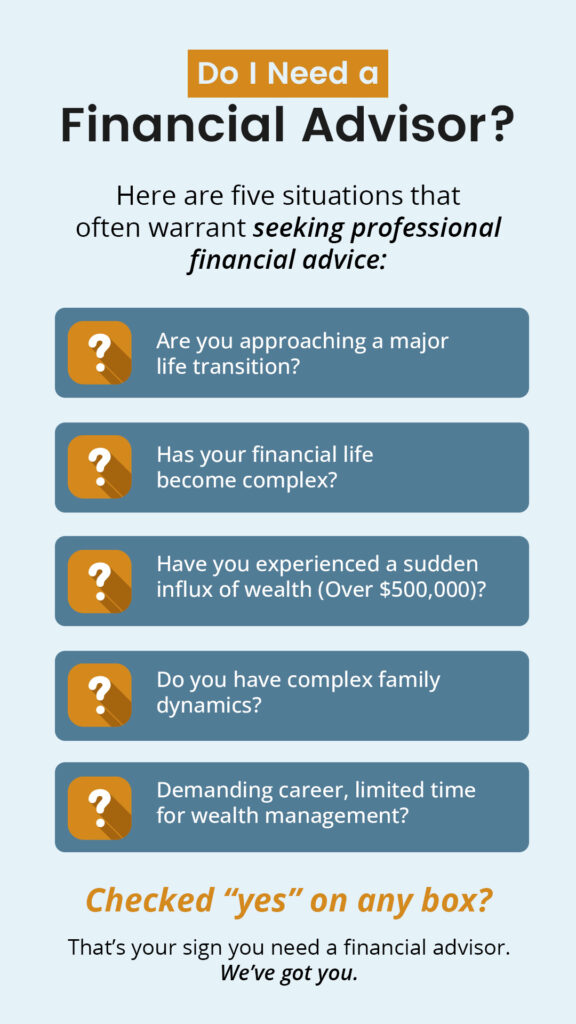

Usual reasons to take into consideration a financial advisor are: If your monetary situation has become more intricate, or you do not have self-confidence in your money-managing abilities. Conserving or navigating major life events like marriage, separation, youngsters, inheritance, or job modification that might considerably affect your financial circumstance. Navigating the shift from saving for retired life to maintaining wide range during retirement and just how to develop a solid retired life earnings plan.New modern technology has caused even more thorough automated economic tools, like robo-advisors. It depends on you to investigate and figure out the appropriate fit - https://www.easel.ly/browserEasel/14614718. Ultimately, a good economic advisor needs to be as conscious of your investments as they are with their very own, staying clear of excessive fees, saving cash on tax obligations, and being as clear as possible about your gains and losses

The Only Guide to Clark Wealth Partners

Earning a payment on item suggestions doesn't necessarily suggest your fee-based consultant works against your benefits. Yet they may be extra inclined to advise product or services on which they earn a compensation, which might or might not remain in your benefit. A fiduciary is lawfully bound to put their customer's interests.

This common allows them to make suggestions for investments and solutions as long as they suit their customer's objectives, danger resistance, and monetary situation. On the various other hand, fiduciary advisors are lawfully bound to act in their client's ideal interest rather than their very own.

How Clark Wealth Partners can Save You Time, Stress, and Money.

ExperienceTessa reported on all things spending deep-diving into intricate financial topics, clarifying lesser-known investment avenues, and revealing ways viewers can work the system to their advantage. As a personal money professional in her 20s, Tessa is acutely aware of the impacts time and unpredictability have on your investment decisions.

It was a targeted advertisement, and it functioned. Check out a lot more Check out much less.

Clark Wealth Partners Fundamentals Explained

There's no single route to turning into one, with some individuals starting in banking or insurance policy, while others start in accounting. 1Most financial planners begin with a bachelor's degree in financing, economics, accountancy, organization, or a relevant topic. A four-year level supplies a solid structure for professions in financial investments, budgeting, and customer service.

Some Known Details About Clark Wealth Partners

Typical instances consist of the FINRA Series 7 and Series 65 tests for securities, or a state-issued insurance coverage license for selling life or health insurance coverage. While credentials might not be lawfully needed for all preparing duties, employers and clients often watch them as a benchmark of professionalism and reliability. We look at optional qualifications in the following area.

Many financial organizers have 1-3 years of experience and knowledge with monetary items, compliance criteria, and straight customer communication. A strong instructional history is essential, however experience shows the ability to use theory in real-world setups. Some programs combine both, allowing you to finish coursework while making monitored hours through teaching fellowships and practicums.

Getting My Clark Wealth Partners To Work

Many go into the area after operating in financial, accountancy, or insurance, and the transition calls for perseverance, networking, and often advanced qualifications. Early years can bring lengthy hours, pressure to develop a customer base, and the demand to consistently verify your experience. Still, the job offers strong long-lasting capacity. Financial planners delight in the opportunity to function carefully with customers, overview crucial life decisions, and frequently accomplish adaptability in timetables or self-employment.

They invested less time on the client-facing side of the sector. Virtually all economic managers hold a bachelor's degree, and several have an MBA or similar graduate degree.

Facts About Clark Wealth Partners Revealed

Optional qualifications, such as the CFP, typically call for added coursework their website and testing, which can prolong the timeline by a couple of years. According to the Bureau of Labor Statistics, personal financial experts make a mean yearly yearly salary of $102,140, with leading income earners making over $239,000.

In various other provinces, there are laws that need them to fulfill certain demands to use the economic expert or financial coordinator titles. For economic organizers, there are 3 usual designations: Qualified, Individual and Registered Financial Organizer.

Some Known Factual Statements About Clark Wealth Partners

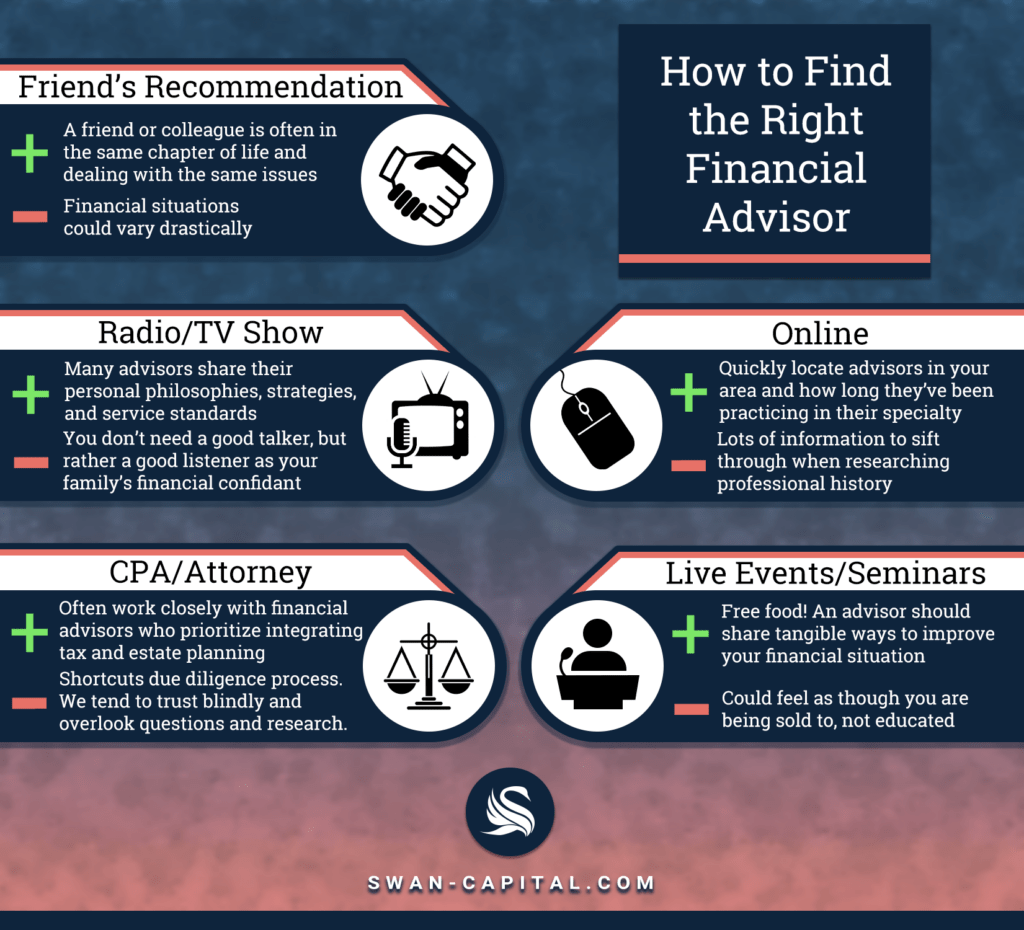

Where to discover a monetary advisor will depend on the type of advice you require. These organizations have personnel who might assist you recognize and buy certain types of investments.